How to Build an Effective Pitch Deck

HeavybitHeavybit

HeavybitHeavybit

How to Build an Effective Fundraising Deck for Devtool Startups

Technical founders often ask us what to include in their early-stage pre-seed and seed fundraising decks. If you’re building something in a highly technical field, for technical users, and you’re pre-revenue, it’s often hard to translate your vision into what VCs might deem a venture-scale opportunity. If you’re trying to raise venture capital for a developer tool, infrastructure, or B2B SaaS product, you’re in the right place.

At Heavybit, we invest in 10-12 early-stage dev tool and infrastructure companies per year. In order to make those investments, we review literally hundreds of pitches, fundraising decks, and opportunities. In this article, we’ll cover: What you need to know to build a better seed fundraising deck, a list of the top do’s and don’ts, and a comprehensive fundraising deck template, with specific content and rationale for each slide. Read on for more details or get access to the template now.

What Is the Purpose of a Fundraising Deck?

The fundraising deck doesn’t simply tell the story of your startup–it can act as a narrative device to walk through the important claims you need to make to create a convincing story that ends with the conclusion you had initially planned. The fundraising deck also acts as a leave-behind or forwardable asset that partners can use to socialize a deal amongst their investment committee or potential co-investors. The most effective fundraising deck not only covers the problem you solve with clear proof points but also covers why your team is most poised to make effective use of capital and capture a market. This may seem easy enough, but it’s hard to take a highly technical story and translate it into a compact 10-12 slide narrative. It’s for this reason that we’re offering some of the Do’s and Don’ts.

A good early-stage fundraising deck should:

- Identify the Problem: Clearly highlight a high-value opportunity in today’s market.

- Present the Solution: Clearly position your startup’s approach as the solution to the problem.

- Indicate Momentum: Indicate early traction you’re making with users (forks, downloads, OSS contributions, community signups, freemium registration, design partners, cloud customers, or otherwise)

- Showcase the Team: Demonstrate your team’s experience with the solution and your type of go-to-market

- Tell the Story: Your deck must tell a clear, brief, and persuasive story.

A good early-stage fundraising deck should not:

- Be too Long: Hone your story to fit into a maximum of 10-12 slides. You shouldn’t have to tell us the history of the internet or cloud computing. If relevant, there’s probably a pre-existing link for this type of info.

- Be too “in the Weeds”: Busy investors need the 10,000-foot view. Provide an executive summary in terms that matter to them. You can add an appendix with deep technical information but don’t expect people to immediately read or understand it.

- Make Unsupported Claims: Didn’t back up every assertion in your pitch? Investors will sniff out and call “BS.”

- Ignore the Landscape: You’re not building in a vacuum. A tight-but-comprehensive overview of your competition including similar startups and large incumbents shows you know the realities of disrupting a category or defining a new one.

- Contain Loose Ends: The core of your pitch is why your company is ready for, and worthy of, capital investment. Avoid commentary that may incite open-ended questions that pull the conversation sideways.

What a Fundraising Deck Should Include:

For devtool companies, we’ve found that the strongest pre-seed and seed-stage fundraising decks generally nail these four important goals:

- Set the Stage: For the problem your startup solves

- Walk Through Related Assertions: Providing supporting evidence for each

- Build a Convincing Story: That connects your company to the solution

- Close strong: With a compelling conclusion leading to a logical inevitability

How to Structure Your Pitch Deck

With your pitch deck, your goal is iteratively building a comprehensive, stepwise narrative over a series of assertions that you prove conclusively.

The best, most successful pitch decks focus on a single claim on each slide and provide evidence for each slide’s claim before moving on. If convincing, this creates the next question in the listener’s mind, which you answer on the next slide. The slides are sequenced so that the natural questions which arise from each claim are answered next, avoiding the listener ever feeling like there’s a hole in your story.

Going from Broad to Specific

We’ve also found that a particularly effective structure tends to be starting from the broadest thesis your audience can follow, then moving through a series of more-specific claims.

In effect, you’re telling a story that states, “You have to believe X before you can believe Y, before you can believe Z.” What you’re effectively doing is starting with a “Big Problem” of great and widespread significance, then narrowing it down with your story to arrive at the seemingly foregone conclusion: That your startup, and only your startup, is “The Only Solution to the Big Problem.”

Example Pitch Deck for Seed-Stage Startups

Let’s synthesize everything we’ve discussed above into a pithy and impactful template.

Slide One: Problem (The Problem in General)

“What problem are you solving?”

Your first slide should cover the general problem. As we mentioned earlier, a highly effective approach is starting with a broad challenge that underscores the importance, scope, and value of a potential solution, as well as its timeliness. Ideally, this slide should also answer the question “What has changed?/Why now?”

One tried-and-true format for slide one is:

Statement of truth/industry trend + “but” + Challenge

Example Problem Statement:

“By 2025, 45% of organizations worldwide will have experienced attacks on their software supply chains*, but the problem is that more than 50% of companies today lack end-to-end supply chain visibility*. Companies are flying blind."

*Includes citations from reputable media, analysts, and/or well-established industry research sources.

Slide Two: Solution (the solution in general)

“OK, I buy that this is a problem, so what’s the solution?”

If there is, in fact, a problem, what is the ideal, general solution in the abstract? One effective way to start the story of this slide is with: “Imagine a world where..."

Example Solution Statements:

- You had real-time visibility into supply chain management

- Endpoints were auto-encrypted from a single policy

- Policies could be edited as easily as GitHub repos

Slide Three: Product (aka The Specific Solution)

“OK, I buy that this is a solution, but what’s the product?”

Assuming your generalized solution is the correct approach to solving the problem, what are the specifics of how your startup implements the solution?

Your product slide can include:

- Notes on product approach

- A link to a demo

- An example of working software

Your product slide should include:

- Concrete screenshots if available

- Otherwise, diagrams/wireframes that show your startup’s solution

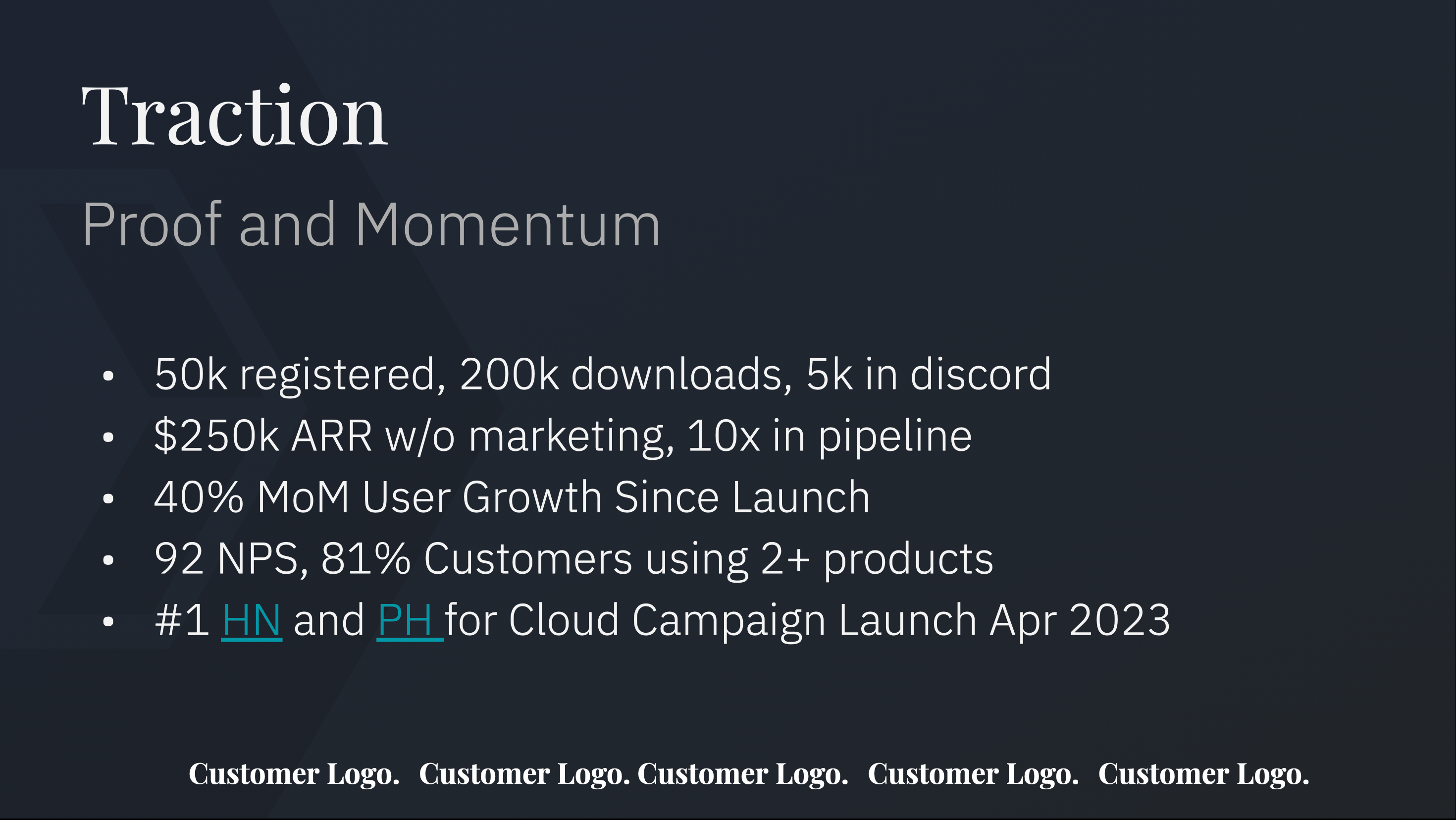

Slide Four: Traction (Proof and Momentum)

“OK, I buy that this is a product, but will people want it?”

It’s time to convince your audience that your solution works. Your momentum slide should include clear examples that your startup is gaining traction, some ways to show that include offering:

- Activity Metrics: Demonstrating real-world usage at scale

- Developer/Practitioner Love: Showing successful ProductHunt, HN, GitHub, or other early developer wins. Pre-seed companies may also want to include early design partner usage

- Customer Testimonials: Well-known customer logos with glowing quotes and early case studies

- Progress Timeline: Showing velocity of product development and/or customer growth

- KPIs: If you have customers and revenue, include high-level metrics here

Slide Five: Business Model (pricing and scalability)

“OK, I buy that people will want it, but how will you make money?”

Your go-to-market slide is your chance to prove to investors that you have a business that not only works in the current market but will scale in the future.

Topics to cover include:

- Business model: What is the business model—what are you selling? What do you charge money for? How does that model scale?

- Pricing and Packaging: If you have pricing today: Are you pricing your product properly today, or simply putting out multiple pricing tiers because that’s what every other startup does? If you don’t have pricing today: what is your imagined pricing model? If you’re offering a freemium tier, can you clearly explain why, as well as how you’ll convert free users to paid users? How do you plan to evolve pricing and packaging to scale properly as the company grows and potentially moves upmarket?

Slide Six: Go-to-Market

“OK, I buy that people will pay you, but how will you find and convert customers at scale?”

- Funnel: Show your current or imagined future funnel. How do customers enter the top of the funnel? How do they hear about you? Where do leads come from? What are the current or imagined stages they go through as they become more engaged, convert to paying customers, and expand their usage and spend? Focus on how you believe the business will operate at scale in the future (not what you’re planning to do next month).

- Sales & Marketing Activities: What activities will you pursue that drive users/customers into the funnel or pull them through the funnel and at which stages?

- Funnel Metrics and KPIs: How does your revenue funnel (tracking leads, conversions, opportunities, and closed-won deals) work? How is it performing?

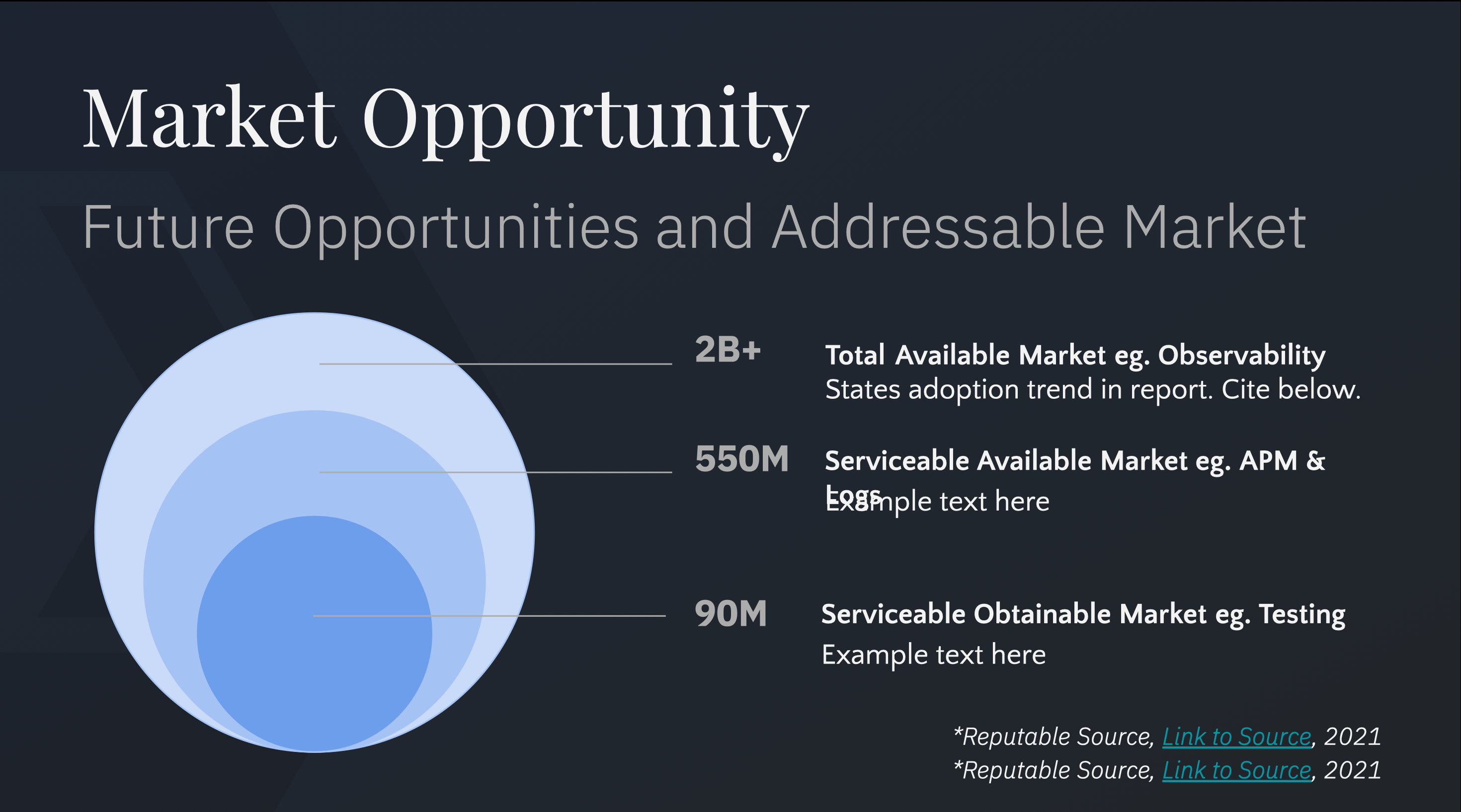

Slide Seven: Future Opportunities and Total Addressable Market

“OK, I buy that you can find and convert customers, but will the market be big enough?”

It’s time to start selling the dream. Use this slide to explain how your current opportunity is already huge but gets even bigger when taking a zoomed-out view. We prefer the concentric circles diagram with 3 circles. From smallest to largest, the sections include:

- Current or Near-Term Product: What is the basic version of the product you have today or soon, and what is its serviceable obtainable market (SOM)--the portion of the market you can realistically capture today given current resources, advantages, market conditions, competitors, trends.

- Longer-Term Roadmap Product: This is the thing that achieves your product vision and has much more surface area and value to customers and relatedly a much bigger Serviceable Available Market (SAM)- portion of the market you can capture provided that your business model works.

- Pie-in-the-Sky Vision: The barely believable version of your product/product portfolio in the distant future if you have created or disrupted a category: What is the largest possible version of your vision? This also relates to your Total Available Market (TAM)—the total market demand and maximum revenue your category represents.

Each of these circles represents a larger product roadmap and therefore larger value delivered, a larger set of potential users within a company and a larger set of potential customer companies, and therefore dramatically larger potential revenue/addressable markets. This slide shows how your long-term vision is aligned with a very large long-term market opportunity.

As with all slides, it’s important to provide evidence and proof points—respected analyst firms in your space can be a source for market numbers.

Slide Eight: The Ecosystem - Competitive Landscape

“OK, I buy that the market Is big enough, but how will you capture it instead of someone else?”

Since you’re talking about such a great opportunity, what about your competitors, who have also clearly recognized the opportunity and who, by their own presence and success, indicate that the market is worth serving?

Use your competitive landscape slide to prove that your startup has all the makings of a breakout category leader with:

- A Competitive Quadrant: Choose 2 major differentiators of your product and use those as your X and Y axis. Explain why your startup is in the top-right quadrant.

- A Quick Overview of Competitor Shortcomings: How are your competitors over-indexed in the wrong areas, giving your startup the chance to take the lead? Note: Running down your competitors should not be the sole focus of this slide or your story. Your goal is to tell the story of how your startup will succeed. Focusing too much on trash-talking competitors is an amateur move that will cost you credibility in the eyes of any decent investor.

- Additional Context: Sometimes if you are creating a category, you won’t have direct competitors but rather substitute products or you will be competing against what people currently do (including building solutions themselves)

A Note About Entrenched Enterprise Competitors

Founders often ask how they can position themselves in markets with deeply entrenched competitors. Quite frankly, it can be a good thing to have a well-funded 800-pound gorilla in the room. Enterprise incumbents can be an indicator of significant market size and opportunity and help you make the case that your startup has plenty of headroom to grow.

Slide Nine: Showcase the Team

“OK, I buy that your idea has a shot at succeeding in the competitive landscape, but why are you the best people to bet on?”

Why is your team uniquely equipped to take on the challenge? Use this slide to briefly introduce key team members, their backgrounds, and relevant accolades. You can also use this slide to name-drop additional advisors and/or investors to strengthen your case.

Slide Ten: Fundraising Asks and Call-to-Action

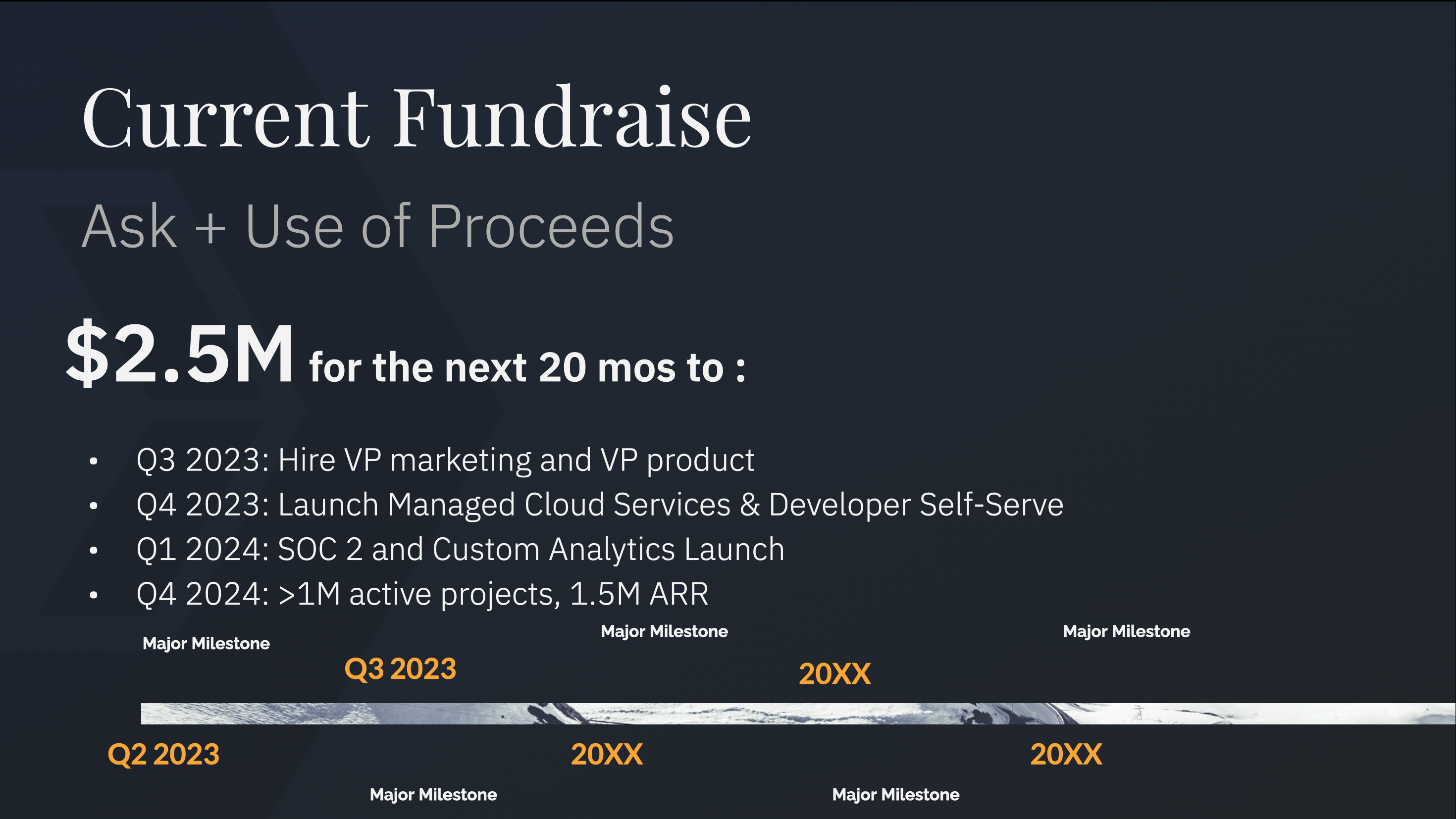

If there was ever a time to be straightforward, it’s when you present your fundraising ask slide. It’s time to get down to brass tacks by clearly stating:

- Your Fundraising Ask: State how much you’re raising and your deadline to close. Consider including a rough post-money valuation range in your talk track as well.

- Your Use-of-Proceeds Plan: Explain your plan to deploy your capital and how it will achieve your goals. Once funding is complete, what are the major milestones on your roadmap, and when will your startup accomplish them? Consider including up to five major milestones for the next 12-18 months to indicate you’ve already got a plan towards which you’re working.

- Next Steps: Identify what parties should reasonably expect of each other in the immediate future and by when.

Appendix Slides

Should you need it, you can include some appendix slides with additional topics that can be flipped to during discussion after your initial pitch, or during your pitch if investors get hung up on specific details. These slides are for detailed topics that would otherwise have obstructed the flow of your previous slides.

When pitching, sometimes you will hear the same questions/confusion/feedback from multiple people. This indicates a problem with your deck that you need to fix. However, sometimes you will find that certain investors get fixated on certain side-topics which are valid but not part of your flow and not of interest to all investors. Having detailed slides that address those topics in the appendix is a great way to be prepared for those discussions.

Your Fundraising Deck Is Important, but It’s Just One Step

One final “don’t”: Don’t consider your pitch deck some kind of holy scripture delivered from the mountaintop. This is a living document and you should iterate over time. It may be tempting to obsess over slide formatting, but this is just one aspect of fundraising. In most cases, pitch decks improve over time and a perfect deck doesn’t guarantee you’ll secure a term sheet or lead investor. Most investors expect you to send a pitch email, present the deck and your vision as part of an introductory call, take a handful of diligence meetings, produce P&L plans and a list of design partners/customers, offer access to various financial projections and legal docs, and stay in touch to answer any questions that weren’t answered in earlier meetings or diligence calls. A good investor cares enough to understand your startup, double-checks your assumptions, and interrogates the opportunity and team enough to contribute beyond capital. Your deck lets you add a concise, persuasive story about your startup. It’s a starter artifact towards a hopefully much longer partnership and startup journey.

We understand that building out decks and making high-stakes presentations can be stressful for new founders who don’t have experience. Hopefully, this article has given you a clearer sense of best practices for building a seed-stage pitch deck. (And if, by any chance, you’re ready to pitch your own early-stage devtool or infrastructure startup to an investor that specializes in scaling these types of companies, contact us here.)

Get the Heavybit Pitch Deck Template

Additional Resources

Content from the Library

Generationship Ep. #7, Investing in AI with Wei Lien Dang of Unusual Ventures

In episode 7 of Generationship, Rachel speaks with Wei Lien Dang of Unusual Ventures about the landscape of Generative AI and...

EnterpriseReady Ep. #46, Open Source Management with Donald Fischer of Tidelift

In episode 46 of EnterpriseReady, Grant speaks with Donald Fischer of Tidelift. Donald shares lessons from his early career...