How AI Is Reshaping Enterprise Infrastructure

At Heavybit, we invest in enterprise infrastructure. This is an evolution from our early days as developer tools specialists, but the core thesis remains the same: We back founders building for technical users.

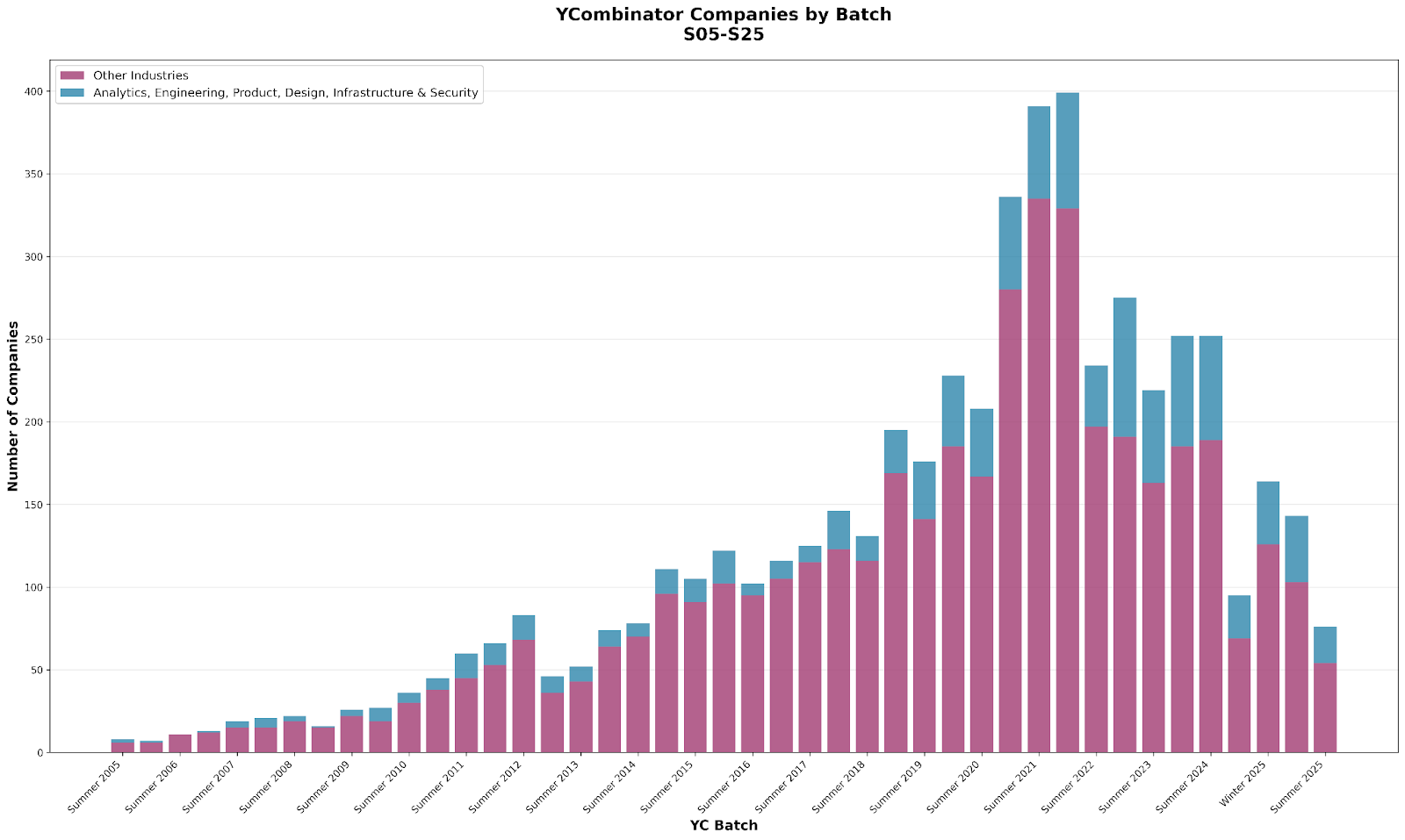

What’s changed is the scope of that audience. Technical users are no longer confined to engineering teams at tech startups. They now power critical workstreams across nearly every major business on the planet.Take JPMorgan Chase, for example. Over 55,000 employees, more than 20% of the entire workforce, now work in tech roles like software engineering, DevOps, and data science. It’s a bank with a huge brick and mortar footprint, but its business runs on software. This shift is reflected in startup trends too: In recent YCombinator batches, the share of companies building for technical users has grown from around 10% in 2017 to over 30% today.

While it may feel like early winners have emerged with strong moats, we’re still in the earliest innings. Assuming foundational models continue improving at their current pace, many of the defining infrastructure companies of the AI era likely haven’t even been imagined yet. All the noise around vibe coding and AI codegen? Those are just tremors from an offshore quake. The real tsunami is still on its way.

Racing to Capture the Budget

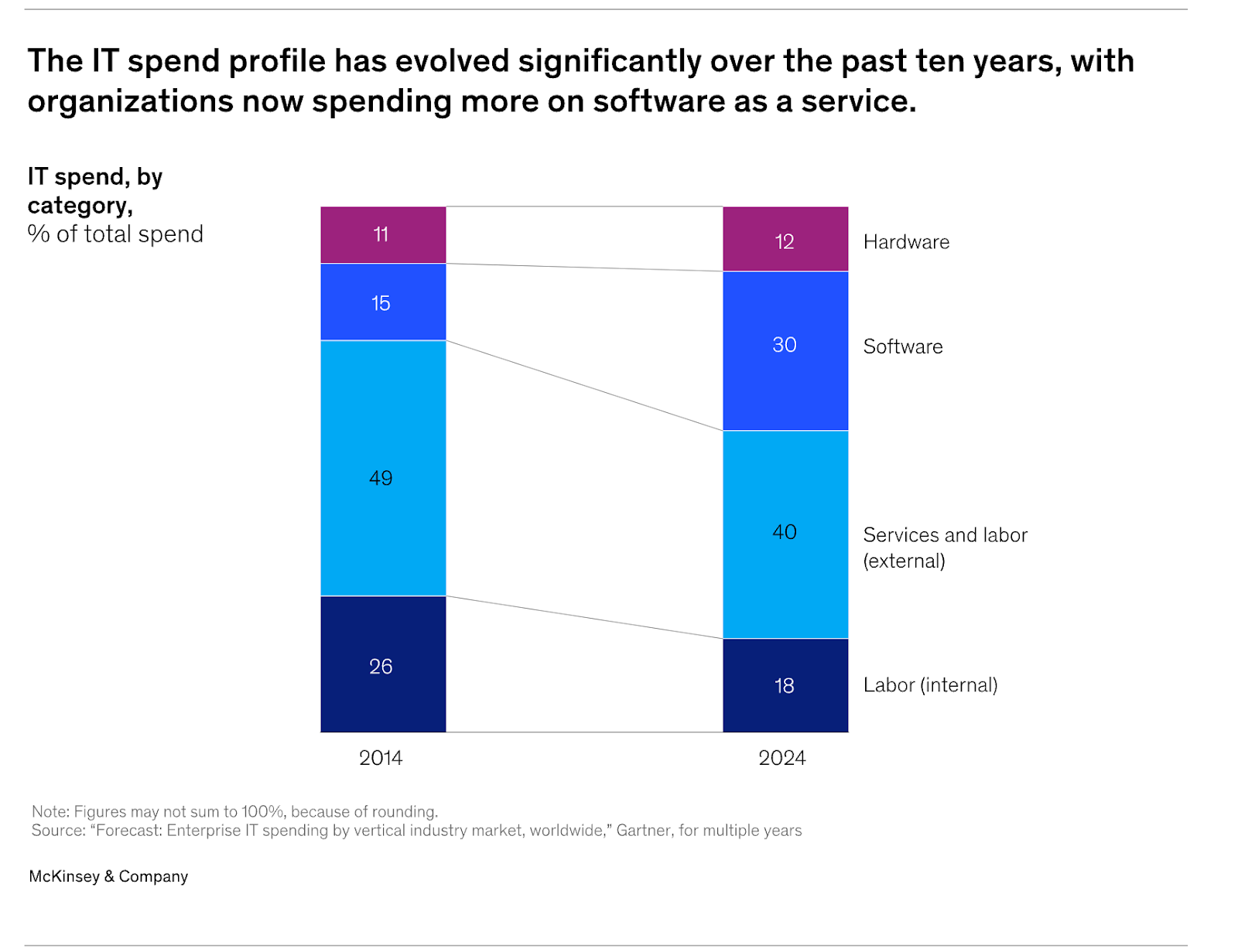

According to McKinsey, in 2014 enterprises spent 75% of their IT budgets on labor. By 2024, that number dropped to 58%. Hardware spend stayed flat—the biggest change came from a surge in external software spend, as SaaS tools ate into internal headcount.

This trend will only accelerate with the rise of AI.

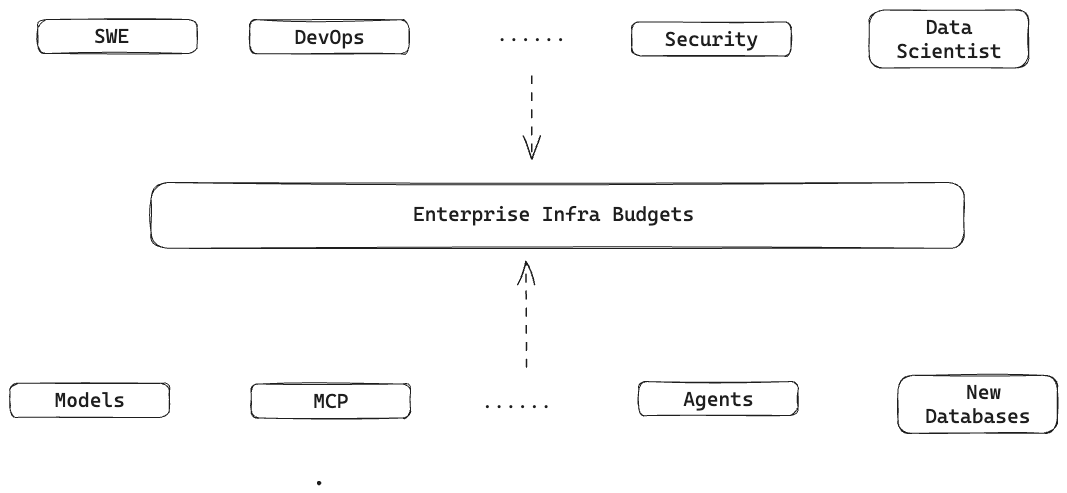

Two major categories of new infrastructure companies are emerging to capture this shift:

User-Down Startups

These startups give superpowers to existing technical personas, or aim to replace them entirely, by embedding intelligence into their workflows from the top down. Some are AI-native productivity tools (like Cursor), while others reimagine the workflow altogether (like Claude Code). Their main competitor is often just a new feature in an incumbent tool: Why adopt Nao when Hex just shipped Magic?

Tech-Up Startups

These companies build the underlying stack for AI-native applications. The first wave included evaluation frameworks and vector databases. But a new set of primitives is coming—tools that make the emerging intelligence stack usable by builders and deployers. Many of these companies will sell into the same enterprise infra budgets indirectly, by powering the top-down apps.

Winning Founding Teams for Each Segment

When evaluating early-stage companies, we focus on founder-market fit and total addressable market. But the signal I’m looking for is less “Can they build the product?” and more on whether the founder can demonstrate that they can win deals and build sales momentum. For me, that signal is different for each of the two segments.

For user-down companies, at least one founder must have deep experience in the role they’re trying to augment or replace. You can't sell DevSecOps tooling if you do not speak the language of DevSecOps. A prime example is Harvey, where one co-founder was a lawyer and half of the first 120 hires came from top law firms.

For tech-up companies, I look for founders who know how to build for developers: Great developer experience, smart open-source strategy, and real community building. These users hate being sold to, but they are drawn to great docs and communities that help each other debug in online spaces like Discord.

If you're building in either of these categories, I'd love to hear from you: amir [at] heavybit.com

Content from the Library

Can You Build a Company Around RL?

During a discussion earlier this week with a friend working on an RL engine at a major academic lab, he mentioned his strongly...

So You Want to Be an AI Engineer?

The "AI Engineer" job title is a recent invention, and companies are hiring a lot of them. I've generally assumed an AI engineer...

Language as Proxy for Taste

Most developers agree that code will be increasingly written by agents. If that’s true, then familiarity with a specific...