How to Generate Financial Reporting for Board Meetings

Josh AharonoffFounder & CEO

Josh AharonoffFounder & CEO

Mighty Digits

How to Get Financial KPIs Ready for the Board Meeting

Your startup just closed its first major round after a long and arduous fundraising process.

Now comes the fun, right?

Well…yes and no.

See, you can now focus back on your business…the growth…the people…and everything else needed for that huge exit one day.

But along with the millions in new capital deposited in your bank account comes a new series of meetings that will come up every quarter:

Board reporting.

Let’s get into how to get your financial reports in order, so you can nail your next board meeting.

What We’ll Cover Here

- What Is Board Reporting?

- Who are the Board of Directors?

- What Does a Board Meeting Typically Look Like?

- Why Is This Board Meeting Being Held?

- What Are Some Common Things Discussed at a Board Meeting?

- After the Board Meeting

- Putting It All Together

What is Board Reporting?

Board reporting is the process of reporting your startup’s quarterly progress to the board. Board reports cover topics such as:

- A look back at performance for the last quarter

- A look ahead and plans for the next fiscal year

- A discussion on a key initiative, such as a new product line

- A periodic check-in on how things are going

Who Are the Board of Directors?

Your startup’s board might include regular board members, advisory members, non-voting observers, or even non-active members.

For startups, especially at an early stage, a good board doesn’t just oversee important decisions (hiring top executives, issuing stock).

A good board should ideally include experienced investors and operators who can advise you on the best directions for your startup to go.

While it’s natural to be concerned about board meetings if certain business metrics aren’t going well, they can also be a great opportunity to zero in on areas for improvement.

As we’ll cover below, once you get your finances and funnel in good shape, a good board should be able to help you figure out the next steps to keep your business growing.

What Does a Board Meeting Typically Look Like?

The board meeting typically starts with a call to approve the minutes, and discuss the various sections of the business.

The whole meeting takes as little as 30 minutes, or as long as a few hours.

Board meetings are commonly held in person, though more and more board meetings are taking place virtually.

It’s common for the board to review slides in advance so that the time can be used as efficiently as possible during the meeting.

Why Is this Board Meeting Being Held?

While it’s common for startups to hold board meetings quarterly to review metrics, it’s a best practice to identify both the topics your board will want to hear about, and the topics with which you need help, in advance.

As some will tell you, no one will read a board pack that’s nothing but a metrics review.

At a minimum, it’s a good idea to ensure you cover follow-ups for every action item from your previous board meeting.

You should also plan to set the tone for your next meeting with the asks that matter to you, including key product or hiring decisions, annual budgets, and potential fundraises.

What Are Some Common Things Discussed at a Board Meeting?

It’s common for startups to report on all the areas of the business at a board meeting, including sales & marketing, hiring, product development, and “General & Administrative” (which includes my favorite, finance & accounting).

When it comes to finance & accounting, here is what is typically included:

1. A Summarized Dashboard

This will typically involve 6-8 of the most important KPIs of the business, provided in a visually appealing manner that informs the reader on what is happening in the business at a high level.

It’s also common to show these results relative to another period.

2. A Budget vs. Actuals

This one is important.

Your budget vs. actuals shows the board how well you performed compared to how well you thought you would perform.

(This is where the CFO/head of finance gets the spotlight.)

Over time, the closer you get to your projections, the more confidence the board will have in your next projections.

Note that it’s not crucial to have zero variances across the board. In fact, that’s not even realistic.

What is crucial is to showcase an understanding of why things turned out the way they did to demonstrate that you have a clear understanding of what’s happening and ideas on how you can course-correct as needed.

Did you miss sales? If so, was it because your growth from existing customers was lower than you anticipated, or one of your sales channels had a lower rate of conversion?

Did you miss cash flows? If so, was that because of larger spending or delayed collections from customers?

3. Your Summarized Financials

Your board will often include savvy investors.

In fact, legally, investors must be “accredited” to put money into your startup, which pretty much means they know a thing or two about finance & accounting.

What are the most common financial reports that investors look at?

Financial statements.

If you aren’t familiar with what financial statements are, they are pretty much the format in which financial information on a company gets displayed.

The three most common financial statements are:

- Profit & Loss - Showing you the performance of the business.

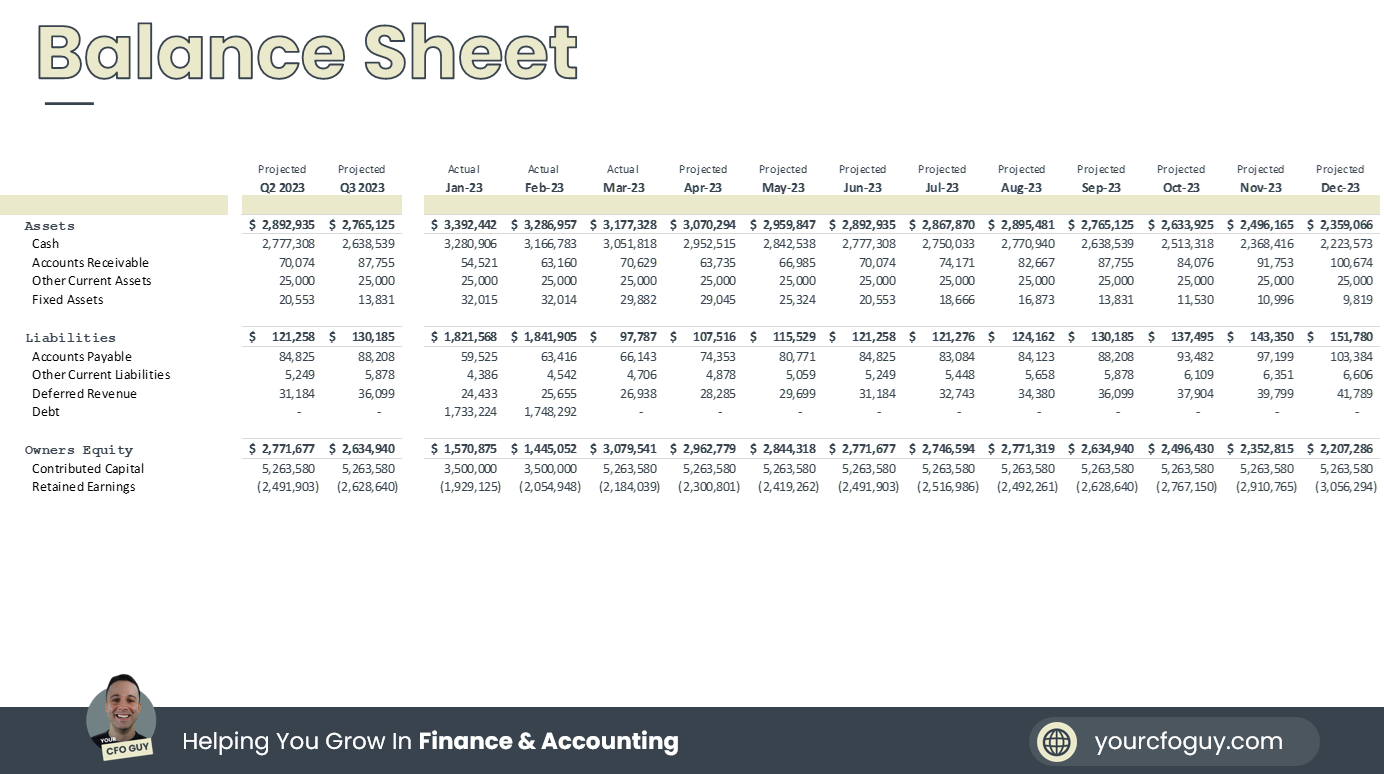

- Balance Sheet - Showing you the assets & obligations of the business.

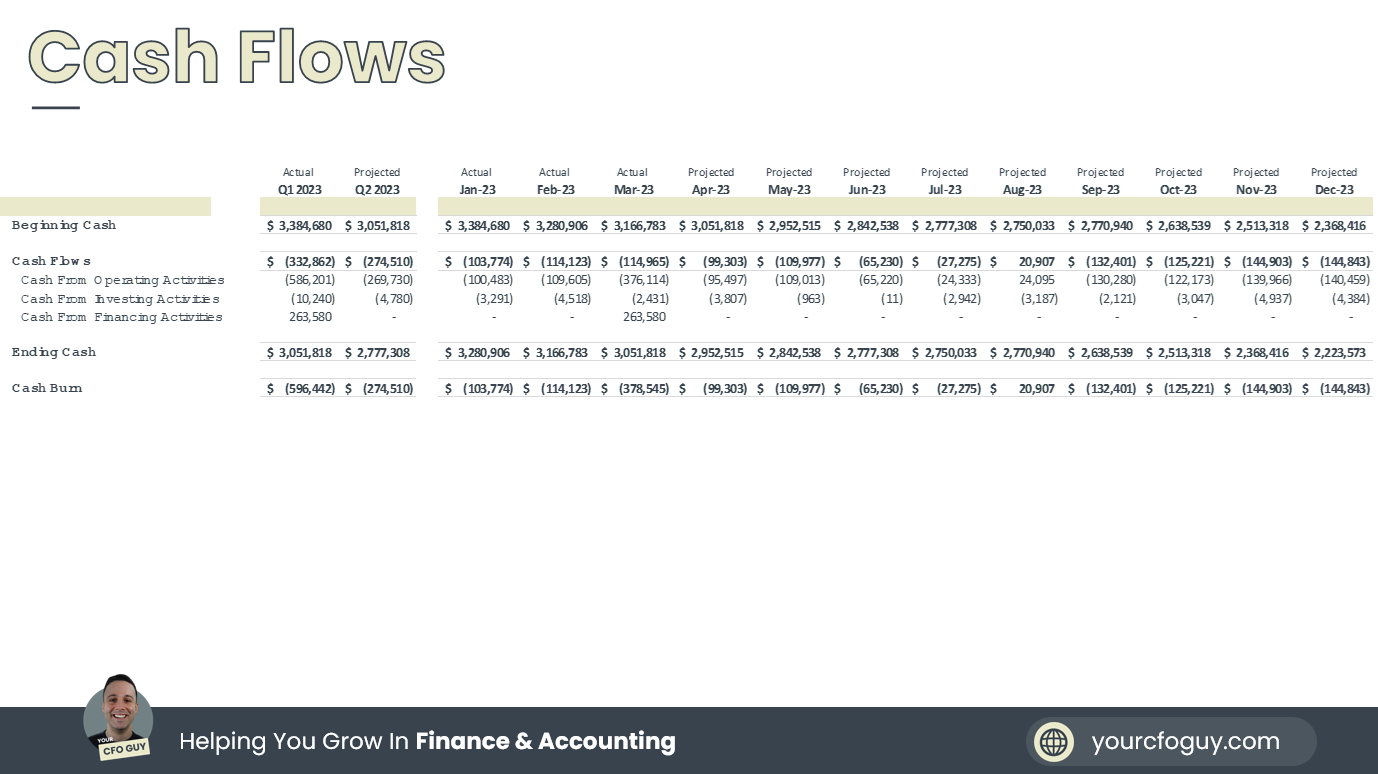

- Statement of Cash Flows - Showing you how exactly your cash is moving each period.

These statements can be detailed, so it’s common to summarize them in a slide deck as such:

After the Board Meeting

As with any key meeting, there will usually be some action items and follow-ups.

You’ll want to document every question you weren’t able to answer, and every request that came out of the board meeting.

Don’t make the mistake of waiting for the board to follow up with you!

Similar to the notes above with the budget vs. actuals report, you want to show that you have a tight grip on everything happening in the business and that your investors’ capital is safe.

From there. you may also want to circle back internally with your team to discuss any feedback received, and which items to focus on for the next meeting.

Putting It All Together

Your board can be an incredibly valuable resource.

That’s why it’s a good idea to ensure you have every detail in order when it comes to your financial reporting.

When you can efficiently walk through the metrics without having to get sidetracked by unclear financial metrics or accounting nuances, you can focus on getting the most value from your board meetings: Getting advice on how to keep your business moving forward.

Hopefully, you found this overview of financial reporting for your board meeting useful. The templates we discussed above are here–use coupon code HBBR100 for a 100% discount. You can find more finance resources for startups here.

Content from the Library

EnterpriseReady Ep. #40, The Uncanny Valley with Alexis Richardson of Weaveworks

In episode 40 of EnterpriseReady, Grant is joined by Alexis Richardson of Weaveworks. They discuss Weave GitOps, insights on...

Founder 101: (Almost) Everything You Need to Know About Cap Table Management

What is a Cap Table? A capitalization table — or “cap table” — is a spreadsheet or table that provides an in-depth view of a...

The ABCs of Directors & Officers Insurance for Startups

As your startup grows, so does your risk. If you’re building an early-stage company, having Directors and Officers (D&O)...